VAT-ID Check provides comprehensive verification of multiple VAT IDs with an easy to use web interface. Enter data manually, copy and paste from Excel, or upload a CSV file. Your results will be available in a variety of formats.

Why VAT-ID Check?

VAT IDs should be externally verified whenever a new creditor or debtor is entered in the accounting system. It is also recommended to perform additional checks on a regular basis, e.g. once per quarter.

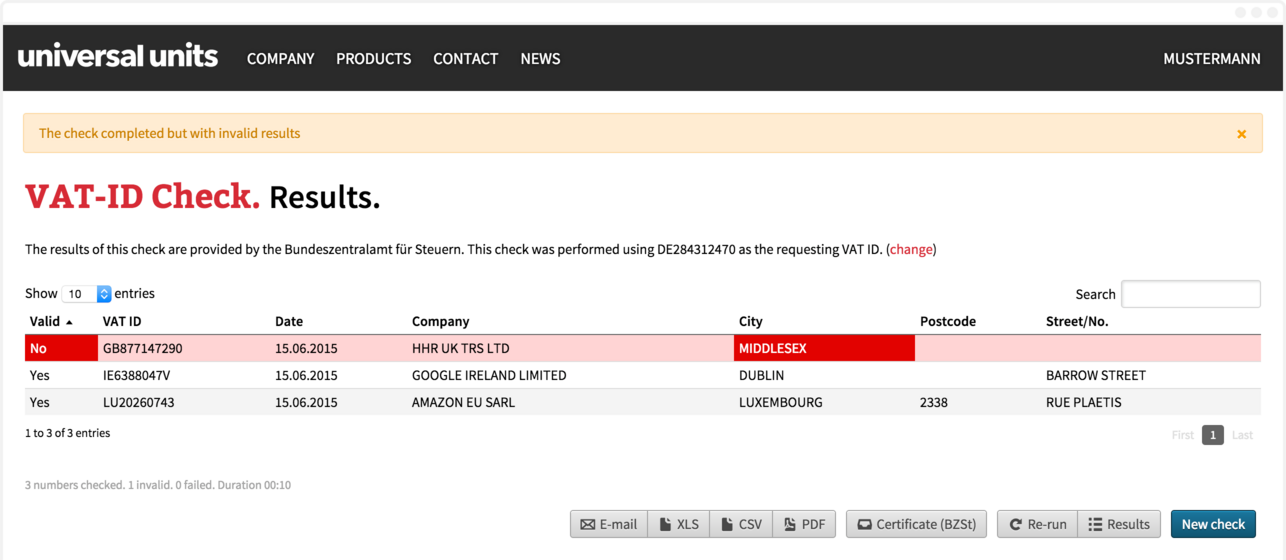

In addition to simple VAT ID checking for all European Member States, it is possible to perform the qualified checks required by German tax authorities.

Key features.

VAT-ID Check has a wide variety of features that will cover all your needs when it comes to VAT ID verification.

-

VAT ID verification.

Supports VAT IDs from all European Member States. -

Qualified checks for Germany.

With official confirmation from the German Federal Central Tax Office. -

Batch processing.

Check as many VAT IDs as you like with just one click. -

Address verification.

Discover invalid addresses quickly to keep your records up to date. -

Copy & paste.

Copy directly from programs like Excel. -

CSV upload.

Upload exported data from your current tools (e.g.: SAP, CIM, Excel). -

Export.

Get your results as CSV, PDF, XLS, or via email.