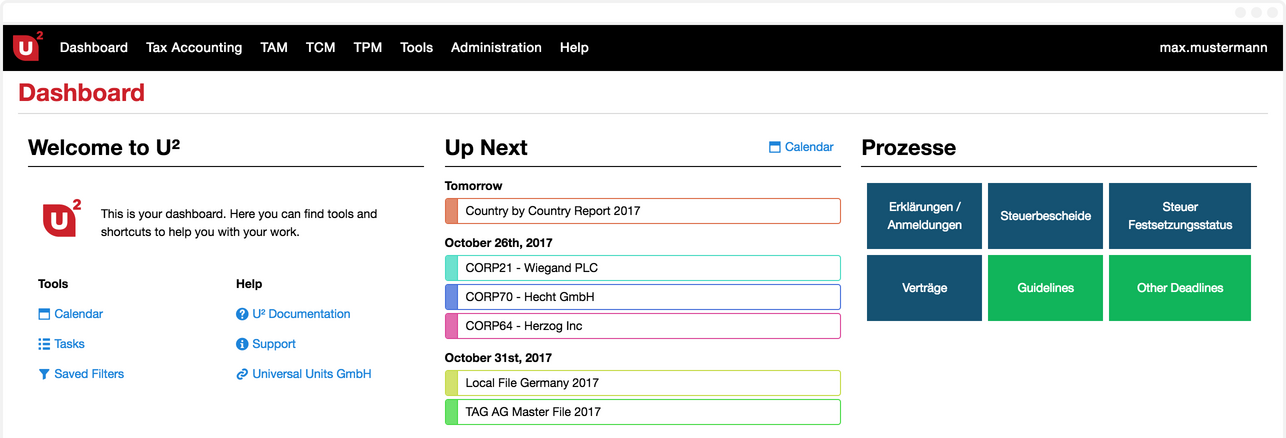

Universal Units is a web based business application for management, tracking and documentation of business processes. The core framework provides a base system to run stable business applications for your company or group.

- Master Data:

- Units (legal units, permanent establishments, groups/sub-groups).

- Currencies, Exchange rates, Countries.

- Currency conversion from/to any currency.

- Time dependent unit hierarchies (e.g. group structures, segments, etc.).

- User management with flexible and powerful authorization rules.

- Module customisation (e.g. user defined tax types, status, audit companies, etc.).

- Flexible management of closing periods (e.g. day, month, quarter, year, etc.).

- Calendar function with deputy options.

- Task list.

- Option to attach any type and number of files per record.

- Recording of comments.

Modular.

The following Global Tax Management solutions are available for Universal Units:

Tax Compliance

Management and Tracking of Deadlines and Audit Objections.

Tax Accounting

Data Entry and Calculation of current/deferred taxes and IFRS Notes.

Transfer Pricing

Transfer Pricing Documentation according to the OECD 3 Tier Approach.

DAC 6

EU Mandatory Disclosures

DAC 7 – Managed Service

Transfer of DAC7 data to the BZSt

CbCR

Generation of Country by Country Reporting in OECD XML format.

Public CbCR

Public CbCR preparation in accordance with HGB §342m

Pillar 2

Calculation of the top-up tax and submission of the Globe Information Return (GIR) to the BZSt